Archived information

This content is archived because Status of Women Canada no longer exists. Please visit the Women and Gender Equality Canada.

Archived information is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Quarterly Financial Report

For the quarter ended June 30, 2013

Statement outlining results, risks and significant changes in operations, personnel and programming

1. Introduction

Status of Women Canada (SWC) is a federal government organization that promotes equality for women and their full participation in the economic, social and democratic life of Canada.

SWC works to advance equality for women and to remove barriers to women’s participation in society, putting particular emphasis on three priority areas:

- increasing women's economic security and prosperity;

- encouraging women's leadership and democratic participation; and

- ending violence against women.

SWC is also responsible for providing strategic policy advice and gender-based analysis support, administering the Women’s Program and promoting commemorative events related to women and girls in Canada. The organization also plays an important role in Canada’s efforts to meet its international obligations on gender equality.

Further details on SWC’s mandate, raison d’être, responsibilities and program activities may be found in the organization’s 2013-2014 Report on Plans and Priorities and 2013-2014 Main Estimates.

SWC management has prepared this quarterly financial report as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. The report, for the quarter ending June 30, 2013, should be read in conjunction with the Main Estimates and Supplementary Estimates. It has not been subject to an external audit or review.

Basis of Presentation

SWC management has prepared this report using an expenditure basis of accounting. The accompanying Statement of Authorities includes the spending authorities granted by Parliament and those in the organization’s Main Estimates and Supplementary Estimates for the fiscal year 2013-2014. This quarterly financial report has been prepared using a special framework designed to meet financial information needs with respect to spending authorities.

All Government of Canada expenditures must be authorized by Parliament. Approvals take the form of annually approved limits or legislation on statutory spending for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant allowing the Government of Canada to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

The organization uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the Departmental Performance reporting process. However, the authorities approved by Parliament remain on an expenditure basis.

2. Highlights of fiscal quarter and fiscal year-to-date results

This section highlights the significant items that contributed to the net decrease in resources available for the year and in actual expenditures for the quarter ended June 30.

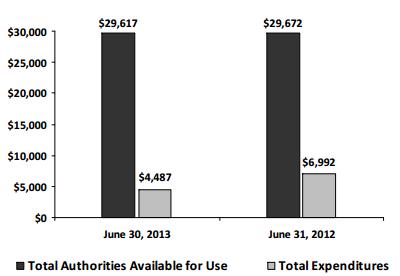

Figure 1

(in thousands)

Figure 1 outlines the total authorities available for use and total expenditures for the fiscal year as atJune 30.

Significant Changes to Authorities

As of June 30, 2013, total authorities available for the year have decreased by less than 1% ($55K) compared to the same quarter of the prior year. This net decrease is a combination of a decrease in Vote 25 – Operating Expenditures ($157K) and an increase in Vote 30 – Grants and Contributions ($83K) and an increase in budgetary statutory authorities ($19K).

The net decrease in total authorities available is a combination of decreases and increases, the most notable being the end of funding received in 2012-2013 through the government advertising fund ($250K) offset by a three-year transfer to SWC from the Department of Justice Canada in partnering to fund a contribution project ($83K).

Significant Changes to Expenditures

Compared to the previous year, total net expenditures recorded in the first quarter decreased by $2.5 million as per the Departmental Budgetary Expenditures by Standard Object Table. This represents a decrease of approximately 36% of expenditures recorded for the same period in 2012–2013.

The difference is primarily the result of a decrease in the Transfer Payment standard object spending of 61% or (approximately $2.9 million) due to the fact that projects have payment schedules that vary from year to year. This decrease was offset by additional spending in various standard objects for the organization’s relocation in 2013.

3. Risks and uncertainties

SWC approaches risk as an integral part of its planning process, recognizing the need for strong risk management in all of its operations, as well as at the corporate level. SWC’s corporate risk profile, review of budgetary challenges, management practices and risk mitigation strategies were all monitored on a regular basis by its senior management.

As part of the PWGSC Gatineau Lease-Purchase project, SWC is planning to move its headquarters from Ottawa to Gatineau in 2013. SWC has been working closely with the Treasury Board Secretariat and Public Works and Government Services Canada in determining costs and sources of funds for this move.

This quarterly financial report reflects the results of the current fiscal period in relation to the Main Estimates and Supplementary Estimates (A).

4. Significant changes in operations, personnel and programs

There have been no significant changes in operations, personnel and programs over the last year.

5. Budget 2012 Implementation

No budgetary reductions have resulted from Budget 2012.

Approved by:

Coordinator, Status of Women Canada

Ottawa, Canada

A/Chief Financial Officer

August 19, 2013

Status of Women Canada

Statement of Authorities (unaudited)

For the quarter ended June 30, 2013

| (in thousands of dollars) | Fiscal year 2013–2014 | Fiscal year 2012–2013 | |||||

|---|---|---|---|---|---|---|---|

| Total available for use for the year ending March 31, 2014* | Used during the quarter ended June 30, 2013 | Year to date used at quarter-end | Total available for use for the year ended March 31, 2013* | Used during the quarter ended June 30, 2013 | Year to date used at quarter-end | ||

| Vote 30 - Operating expenditures | 9,339 | 2,355 | 2,355 | 9,496 | 1,966 | 1,966 | |

| Vote 35 - Grants and Contributions | 19,033 | 1,821 | 1,821 | 18,950 | 4,720 | 4,720 | |

| Statutory authorities | |||||||

| Employee Benefit Plan | 1,245 | 311 | 311 | 1,226 | 306 | 306 | |

| Total budgetary authorities | 29,617 | 4,487 | 4,487 | 29,672 | 6,992 | 6,992 | |

* Includes only authorities available for use and granted by Parliament at quarter end

Status of Women Canada

Departmental budgetary expenditures by Standard Object (unaudited)

For the quarter ended June 30, 2013

| (in thousands of dollars) | Fiscal year 2013–2014 | Fiscal year 2012–2013 | |||||

|---|---|---|---|---|---|---|---|

| Planned Expenditures for the year ending March 31, 2014* | Expended during the quarter ended June 30, 2013 | Year to date used at quarter-end | Planned Expenditures for the year ended March 31, 2013* | Expended during the quarter ended June 30, 2013 | Year to date used at quarter-end | ||

| Total net budgetary expenditures | 29,617 | 4,487 | 4,487 | 29,672 | 6,992 | 6,992 | |

| Expenditures | |||||||

| Personnel | 8,398 | 2,388 | 2,388 | 8,190 | 2,062 | 2,062 | |

| Transportation and communications | 605 | 77 | 77 | 639 | 57 | 57 | |

| Information | 131 | 18 | 18 | 382 | 8 | 8 | |

| Professional and special services | 1,069 | 106 | 106 | 1,055 | 62 | 62 | |

| Rentals | 59 | 51 | 50 | 53 | 69 | 69 | |

| Repair and maintenance | 66 | 5 | 5 | 89 | 7 | 7 | |

| Utilities, materials and supplies | 66 | 3 | 3 | 83 | 5 | 5 | |

| Acquisition of machinery and equipment | 188 | 18 | 18 | 227 | 2 | 2 | |

| Transfer payments | 19,033 | 1,821 | 1,821 | 18,950 | 4,720 | 4,720 | |

| Other subsidies and payments | 2 | - | - | 4 | - | - | |

Note: Totals may not add and may not agree with details provided in other public documents due to rounding.

* Includes only authorities available for use and granted by Parliament at quarter end

- Date modified: